Tired of overspending without knowing why? This app feature changed how I see my money

We’ve all been there—checking our bank account at the end of the month and wondering where it all went. You didn’t buy anything big. No vacations, no splurges. And yet, somehow, your balance is gone. I felt the same, until I discovered a quiet, almost invisible feature in an app I already used every day. It didn’t shout for attention, but once I turned it on, it quietly mapped out my habits, revealed hidden patterns, and helped me take control—without stress or guilt. What changed wasn’t my income or my willpower. It was simply seeing the truth about my spending, clearly and kindly, for the first time.

The Moment I Realized I Was Blind to My Own Spending

It was a rainy Tuesday evening when I sat down with my laptop, coffee cooling beside me, ready to check my bank account before paying bills. I wasn’t expecting a windfall, but I also wasn’t prepared for the sinking feeling that hit when I saw my balance. I had been careful, or so I thought. I didn’t go out to eat every day. I hadn’t bought new clothes in weeks. I even packed my lunch most days. And still, the numbers didn’t add up. Where did the money go? I remember staring at the screen, my stomach tight, asking myself, “How is this possible?” That moment wasn’t just about money—it was about trust. I had trusted myself to be responsible, to be in control. But clearly, something was slipping through the cracks. I wasn’t reckless, but I wasn’t aware either. And that lack of awareness was costing me more than just dollars. It was costing me peace.

What I didn’t realize then was that my spending wasn’t made up of big, dramatic purchases. It was the small, everyday things—things so routine they became invisible. A coffee here, a snack there, a quick online order when I was too tired to cook. Add in a few forgotten subscriptions and the occasional delivery fee, and suddenly, hundreds of dollars had quietly disappeared. These weren’t luxuries. They were tiny acts of convenience, comfort, or habit—each one feeling harmless in the moment. But together? They were a leak in my financial foundation. The real problem wasn’t that I was spending too much. It was that I couldn’t see it happening. And when you can’t see something, you can’t change it.

The App I Already Had (But Was Using Wrong)

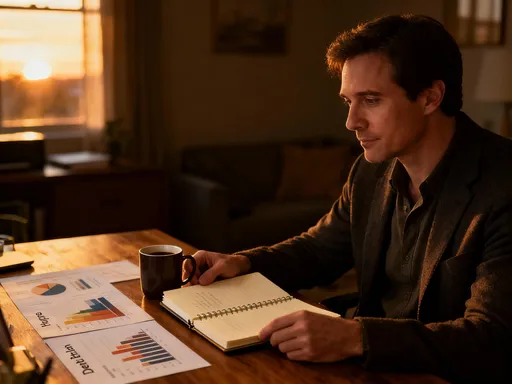

Here’s the funny thing: I wasn’t even trying to fix my finances when I found the solution. I already had a banking app on my phone—one most of us have, actually. I used it to check my balance, transfer money between accounts, and pay bills. That was it. I treated it like a digital wallet, nothing more. I didn’t think of it as a tool for insight or understanding. I remember scrolling through the menu one day, not because I was looking for anything in particular, but because I was waiting for my daughter’s school call and had a few spare minutes. That’s when I saw it: a small tab labeled “Spending Insights.” I tapped it out of curiosity. No flashy graphics, no pop-up tutorial. Just a simple, clean screen with a weekly breakdown of my purchases—groceries, dining, subscriptions, shopping—each category in a different color. I didn’t even know this feature existed, and yet, there it was, quietly tracking everything I’d bought over the past seven days.

What struck me most was how easy it was to understand. I didn’t have to input anything. No spreadsheets, no manual tracking. The app had already done the work. It pulled in every transaction, sorted it automatically, and showed me a clear picture of where my money was going. I remember thinking, “This is what I’ve been missing.” I had downloaded budgeting apps before—ones with complex charts, goal trackers, and reminder systems—but I always gave up after a few days. They felt like homework. This was different. It didn’t ask me to do anything extra. It just showed me the truth, gently and without judgment. I realized then that I didn’t need a new app. I just needed to use the one I already had—more fully, more wisely.

How the Hidden Feature Works—Without Overwhelming Me

Let me explain how it actually works, because I know how intimidating tech can sound. This feature isn’t some complicated financial dashboard with numbers flying everywhere. It’s actually very simple. As soon as you turn it on, the app starts organizing your transactions into categories—things like “Food & Drinks,” “Transportation,” “Subscriptions,” and “Shopping.” You don’t have to label anything. The system does it for you, using something called machine learning, which basically means it gets smarter the more you use it. At first, it might mislabel a purchase or two, but over time, it learns your patterns. For example, it figured out that when I buy something at that little café near my office on a weekday morning, it’s probably my usual coffee order.

Every Sunday evening, I get a small notification—a weekly spending summary. It shows me a pie chart or a bar graph (I can switch between them) that breaks down where my money went. The colors make it easy to spot trends. Red for dining out, blue for groceries, green for subscriptions. If I spent more than usual on something, the app highlights it with a soft alert—nothing harsh, just a gentle nudge. “You spent 20% more on food delivery this week,” it might say. No shame, no scolding. Just information. I love that it’s passive. I don’t have to log every latte or think twice before buying toothpaste. The app does the tracking in the background, like a quiet helper I barely notice. It’s not about perfection. It’s about awareness. And that awareness? It’s been the biggest game-changer of all.

What I Learned About Myself in Just One Week

The first week I used the insights feature, I felt like I was meeting myself for the first time. I had always thought of myself as a careful spender—someone who planned meals, avoided impulse buys, and stuck to a budget. But the data told a different story. The biggest surprise? Delivery fees. I hadn’t realized how often I was ordering dinner when I was tired after work. The app showed me I was spending nearly $120 a month on delivery charges alone—not including the food. That was more than my monthly streaming subscriptions combined. Another shock was the number of subscriptions I was still paying for. I had signed up for a meditation app during a stressful time last year and completely forgotten about it. There it was, $9.99 every month, for something I hadn’t opened in months.

But the most revealing insight wasn’t about money—it was about my emotions. The app showed a clear pattern: on days when I worked late or felt overwhelmed, my spending on small comforts went up. A late-night online shopping spree for kitchen gadgets I didn’t need. A random purchase of scented candles when I was stressed. These weren’t big amounts, but they added up. What I realized was that I was using small purchases as a way to cope—with stress, with exhaustion, with the constant juggle of work, parenting, and household duties. The app didn’t judge me for that. But it did show me the pattern. And once I saw it, I could make a different choice. Awareness didn’t make me perfect. But it made me kinder to myself. Instead of feeling guilty, I started asking, “What do I really need right now?” Sometimes, it wasn’t a new sweater. It was a long bath, a phone call with a friend, or just an early bedtime.

Small Tweaks, Big Results: How I Regained Control

Once I had the data, making changes felt less like a chore and more like a puzzle I wanted to solve. I didn’t set rigid rules or cut out everything fun. Instead, I made small, sustainable tweaks. The first thing I did was cancel three subscriptions I wasn’t using. That alone saved me over $30 a month. I also set up weekly spending alerts for categories like dining and shopping. When I hit 80% of my usual weekly spend, my phone pings me with a friendly reminder. It’s not about stopping me—it’s about giving me a chance to pause and decide. “Do I really want to order takeout again tonight, or would I feel better cooking at home?” That tiny pause has made a huge difference.

I also started scheduling “no-buy” days—just two or three a week, usually midweek when I tend to feel low. On those days, I challenge myself to spend nothing except for essentials like gas or groceries. It’s not about deprivation. It’s about building awareness and intention. What surprised me most was how motivating the visual feedback became. Seeing how much I’d saved on delivery by cooking more at home made me want to keep going. I even started meal prepping on Sundays, not because I had to, but because I could see the payoff. My bank balance wasn’t the only thing improving—my energy and mood were too. I felt more in control, more capable, more like the person I wanted to be. And that confidence spilled over into other areas of my life. I started saying no to things that drained me. I made more time for hobbies. I even began thinking about long-term goals, like saving for a family trip next year.

Sharing It With My Family—And Why It Changed Us

One of the most unexpected benefits of this journey was how it brought my family closer. I started by showing my partner the insights feature during one of our weekly check-ins. At first, he was skeptical. “I already know where my money goes,” he said. But when I pulled up the app and showed him his own spending on coffee and gas, he paused. “Huh. I didn’t realize I was stopping for coffee four times a week,” he admitted. We started using the app together to set shared goals—like saving for a new backyard grill or building a small emergency fund. We linked our accounts (with permission, of course) so we could see our combined spending in real time. It wasn’t about policing each other. It was about transparency and teamwork.

I also introduced the app to my teenage daughter when she started earning money from babysitting. She was excited to have her own cash but didn’t know how to manage it. Instead of giving her a lecture, I showed her how to track her allowance and small earnings in the app. She loved the colorful charts and the little progress bars. She set a goal to save for concert tickets and was thrilled when she reached it in just six weeks. More than that, she started making smarter choices—like skipping a trendy drink at the mall so she could put that money toward her goal. Watching her learn these skills early made me emotional. I wish I’d had this tool when I was her age. Now, money isn’t a source of tension in our home. It’s a topic we talk about openly, calmly, and with curiosity. We’re not perfect—we still overspend sometimes, still forget about subscriptions. But now, we notice. And when we notice, we can change.

More Than Money—How This Changed My Daily Peace of Mind

If someone had told me a year ago that a tiny feature in a banking app could change my life, I would’ve laughed. But here’s the truth: it didn’t just change my finances. It changed how I feel every day. I sleep better now, knowing I’m not blindly spending. I wake up with less anxiety, because I’m not dreading the next bank statement. I make decisions with more confidence—whether it’s saying yes to a weekend getaway or no to an unnecessary purchase. That sense of calm has spread into other parts of my life. I have more energy for the people I love. I’m more present with my family. I even started taking a painting class I’d been putting off for years, simply because I felt like I had the mental space to try something new.

What I’ve learned is that financial health isn’t about being rich or perfect. It’s about clarity. It’s about knowing where you stand and feeling empowered to move forward. This app feature didn’t give me more money. It gave me something better: understanding. And with understanding comes freedom. Freedom from guilt. Freedom from worry. Freedom to focus on what really matters—my family, my well-being, my dreams. I used to think technology was cold, impersonal, something that pulled us away from real life. But this experience has shown me that when tech is designed with empathy and simplicity, it can actually bring us closer to the life we want. It can help us see ourselves more clearly, care for ourselves more deeply, and build a future with intention.

A Tiny Feature, A Giant Leap for Everyday Calm

Looking back, I realize the biggest obstacle wasn’t my spending habits. It was my lack of awareness. I was trying to manage my finances in the dark. That small feature didn’t fix everything overnight. But it turned on the light. It gave me the clarity I needed to make better choices—not because I was forced to, but because I wanted to. And that shift—from confusion to clarity, from guilt to empowerment—is what made all the difference. I’m not saying this app will solve every financial challenge. Every family’s situation is different. But I do believe that most of us already have tools at our fingertips that we’re not fully using. Sometimes, the most helpful thing isn’t a new gadget or a complicated system. It’s a quiet feature, already there, waiting to be noticed.

If you’ve ever looked at your bank account and felt that familiar pang of confusion or stress, I want to encourage you: take a few minutes. Open the app you already use. Explore the menus. Look for that “Spending Insights” tab, or whatever it might be called. You might not see results overnight. But over time, that small act of curiosity can lead to big changes. It’s not about being perfect. It’s about being aware. It’s about giving yourself the gift of clarity, one small insight at a time. And who knows? That tiny feature might just be the start of a calmer, more confident, more intentional life—for you and your family.